June 26, 2023

BNP Paribas partners with Banque des Territoires and the European Investment Fund to launch a new marketplace initiative: a fund to support the rollout of Impact Bonds across the European Union

• Three years after launching the very first Social Impact Bonds fund in France and the European Union, and in line with the recommendations of the Cazenave Report, BNP Paribas is launching a second fund, BNP Paribas European Impact Bonds Fund 2. The new fund, with a target size of €70 million, aims to intensify the development of the Impact Bond market in the European Union.

• Three strategic investors have joined forces to create the fund: Banque des Territoires, part of Groupe Caisse des Dépôts, the European Investment Fund (EIF) and BNP Paribas Cardif, the Group’s insurance subsidiary.

• Managed by BNP Paribas Asset Management, the fund will finance projects that have a positive impact on society or the environment, promoting innovation in public policy while generating savings in government budget.

• 10 projects structured by BNP Paribas have already been chosen to be financed by this new fund.

• To mark the fund’s launch, BNP Paribas is today bringing together project leaders, investors and representatives of the public authorities at L’Ascenseur in Paris (4th arrondissement), home to the first coalition for equal opportunities.

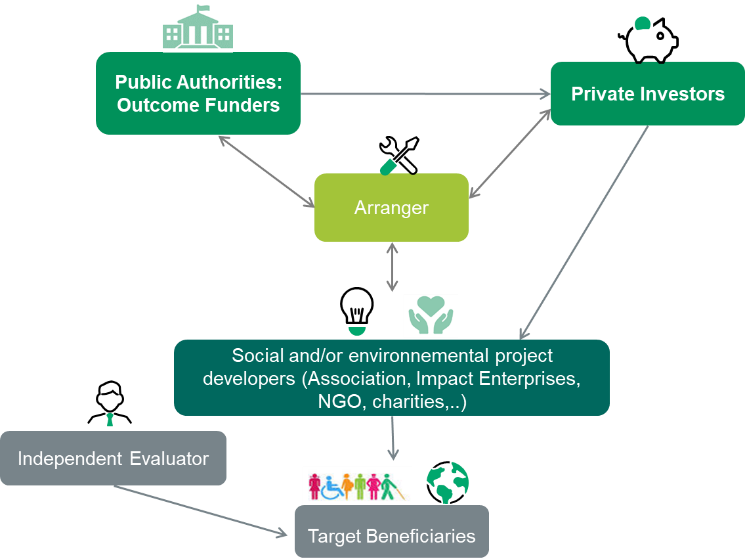

Impact Bonds are a financing tool based on a unique collaborative model between the public, private and social and solidarity economy (SSE) sectors, aimed at generating innovative projects with a positive impact on society or the environment. These impact experiments are deployed by project leaders and pre-financed by investors. The pre-financing is reimbursed by the government if the predefined impact objectives are met. This method of financing enables the large-scale development of effective solutions built on the ground, close to the needs of beneficiaries, focusing on prevention and innovation, in support of public policies while enabling public authorities to avoid certain social and economic costs.

|

With a target size of €70 million, the BNP Paribas European Impact Bonds Fund 2 includes strategic investors such as:

• Banque des Territoires, which has been involved in Social Impact Bonds in France since they first emerged in 2016,

• the EIF, which is providing substantial support for the development of Social Impact Bonds in Europe and France, and

• players wishing to promote societal innovation in regional areas, such as BNP Paribas Cardif, whose approach is part of an average overall positive impact investment objective of €1 billion per year between 2019 and 2025.

Drawing on the expertise and resources of these private investors attentive to societal impact, the new fund will roll out an investment strategy geared towards fostering solutions that address social needs and environmental challenges, in particular the just transition. In France, it will fund projects approved by the Ministries of Labour, Employment and Integration, Economy and Finance, and ADEME, in key areas such as the professional inclusion of disadvantaged young people, the social reintegration of former prisoners or persons with disabilities, the circular economy and the prevention of food waste.

“Banque des Territoires is delighted to be subscribing to this new fund, which stems from an ambitious marketplace initiative. It will promote social innovation in the regions and, as such, is perfectly aligned with Banque des Territoires’ priority mission of social and regional cohesion for more inclusive regions.” Christophe Genter, Head of Social and Territorial Cohesion Department, Banque des Territoires.

10 projects have already been selected for funding by the BNP Paribas European Impact Bonds Fund 2:

• to help more than 1,500 refugees, vulnerable youth and people with disabilities find lasting employment or take a training course leading to a qualification;

• to avoid more than 16,000 tonnes of CO2 emissions;

• to reuse more than 5,000 tonnes of waste.

“The EIF has been involved in the development of Social Impact Bonds since 2015, first in the UK, then in Finland for the integration of refugees, in the Netherlands for the reinstatement of soldiers, and in France for the alternative to incarceration for homeless and mentally ill people. In keeping with its principles, the EIF has also supported several Impact Bond fund managers in France and Sweden, directly and indirectly investing a total of €75 million in Impact Bonds. With the BNP Paribas European Impact Bonds Fund 2 and the support of the InvestEU programme, the EIF is confirming its aim of working towards a more sustainable market by supporting a team with expertise in the structuring and follow-up of Impact Bonds.” Roger Havenith, Deputy Chief Executive, EIF.

To manage this fund and promote project origination, BNP Paribas aims to leverage the experience gained from the pilot fund launched in 2019 with its subsidiary BP Paribas Asset Management, an expert in impact investing and the management of solidarity funds managing €2.7 billion in this asset class, and with the Group team dedicated to structuring Impact Bonds. This €10 million pilot fund was fully invested in three years, via eight projects focusing on child protection, fighting school dropout, combating homelessness among young people classified as NEET (not in employment, education or training) and preventing falls among the elderly, in France, Belgium and the Netherlands. Some of the project leaders’ innovations have already prompted changes in public policy.

Overall, since 2016, 17 Social Impact Bonds (SIBs) structured or co-structured by BNP Paribas have been signed in Europe, in a total amount of €51 million. BNP Paribas has invested nearly €22 million in these SIBs.

“Impact Bonds help accelerate the development of projects that make a genuine contribution to better inclusion of vulnerable populations and to preserving the environment. Since 2016, BNP Paribas has acted as both structurer and investor in Impact Bonds, and we are delighted to continue creating the right conditions for their development alongside committed and prominent investors. Impact Bonds will play an increasingly important role in the coming years to support actions in favour of a fair transition.” Antoine Sire, Head of Company Engagement, BNP Paribas.

Download the press release